How To Set Up Subcontractors In Quickbooks

Many small businesses hire short-term workers or bring on contained contractors to complete projects. Hiring vendors is a nifty way to become an proficient to help out your business organization but properly accounting for expenses and their labor is disquisitional.

QuickBooks gives yous the tools to track these expenses and file 1099-MISCs for your independent contractors. This commodity'southward goal is to set you upward for success, both for accounting and legal reasons.

You may be request yourself, "Why do I need to rail 1099 contained contractor payments separately?" Well, permit me tell you! Separating regular employee payments from contractors is crucial considering of the type of work they do and their relationship to your business organization. Contractors are on-demand or self-employed and do work for you but are not your official employees. Because of this, you need to study independent contractor compensation on a 1099 MISC. From financial and legal standpoints, the partitioning needs to exist clear.

Additionally, knowing whether someone should or should not exist classified as an independent contractor can be complicated. Intuit has a tool that can help explicate the deviation betwixt a 1099 and a Westward-two worker . If you are unsure, achieve out to a tax professional or what nosotros telephone call the source of truth: the IRS website .

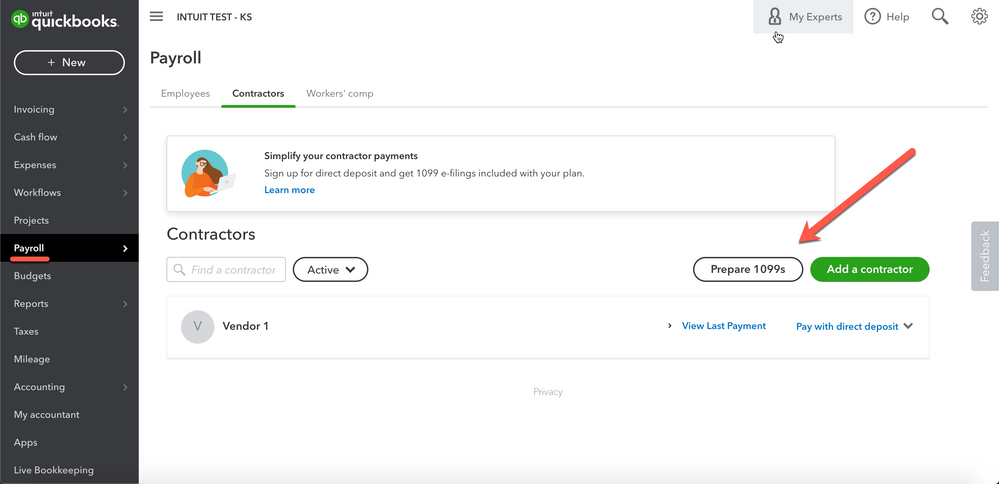

The Expenses tab is one identify where yous can create vendor profiles . If you want to enter your 1099s information yourself, this is the identify for you lot! Go to Expenses>>Vendors and and so click on New Vendor .

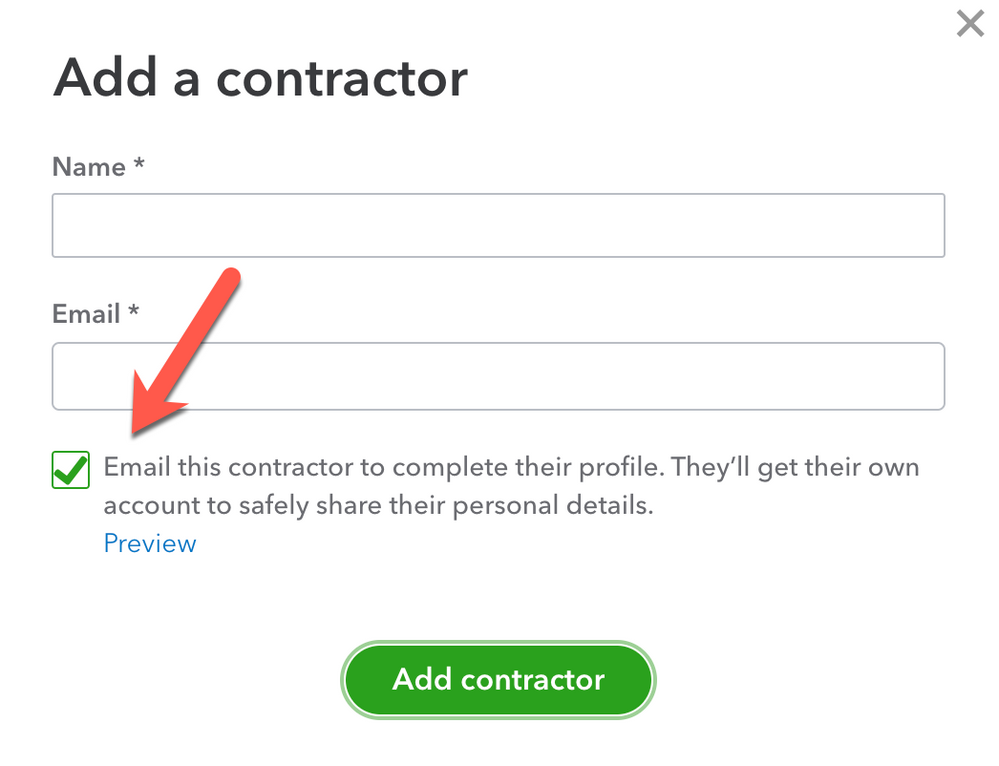

Y'all can also create and manage records for your independent contractors in the Payroll Tab . In QuickBooks Online, you tin find your contractors hither since they, like your employees, are individuals yous pay. Here you have the pick to email your vendors and accept them fill out the data themselves.

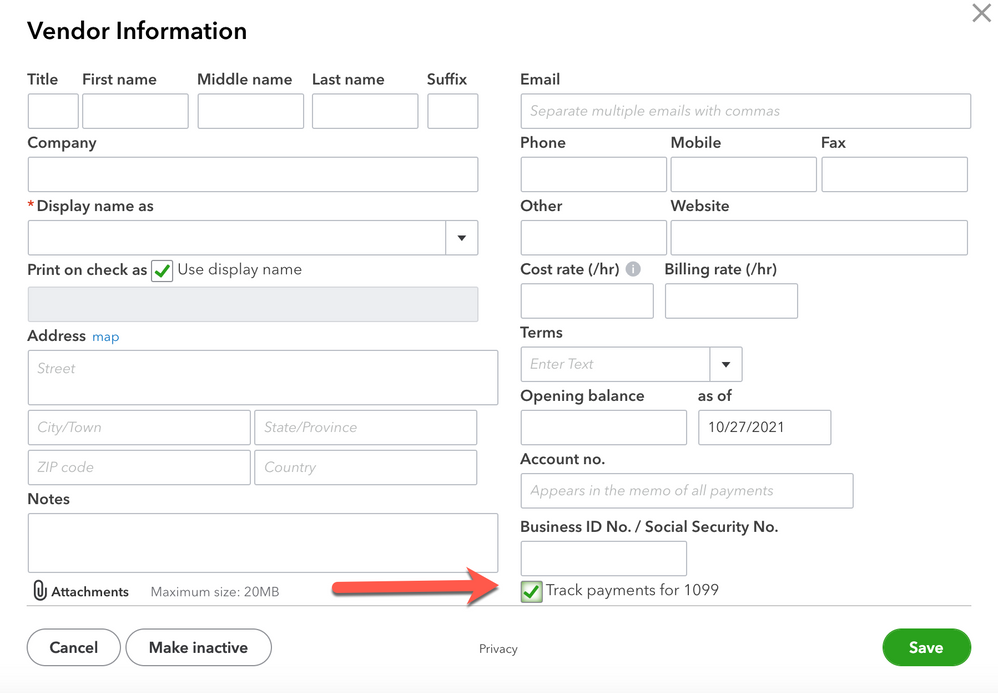

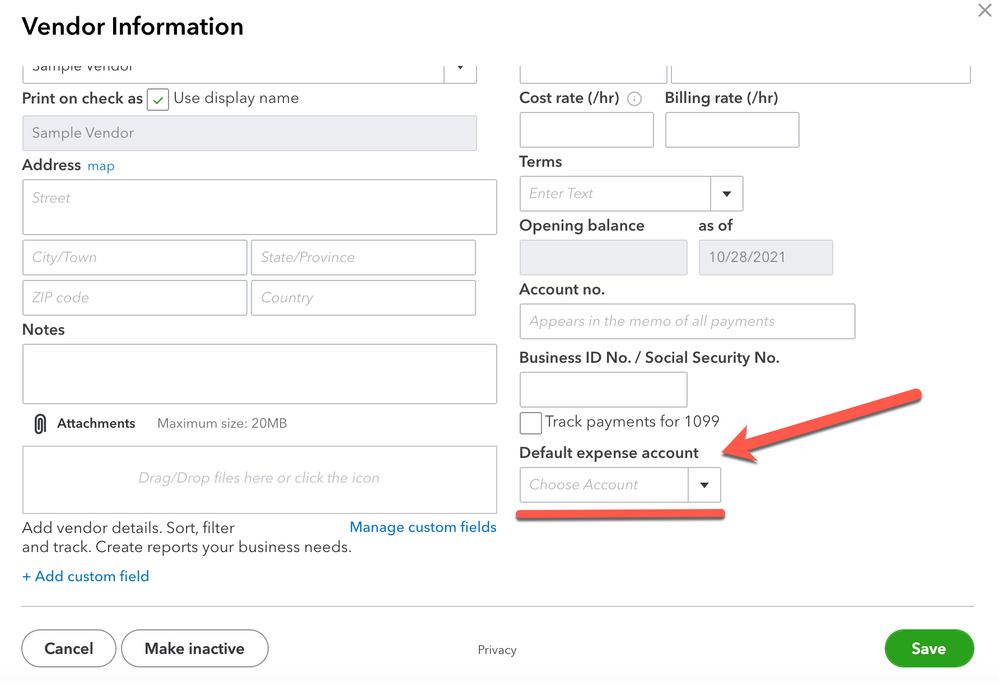

Let's accept a look at the Vendor Information window more closely. You make full out a lot of the same data for vendors as you do for employees. One deviation is the EIN (employee's Identification Number) which is entered on the Business concern ID line. If you have this number, you'll want to fill it in. If not, you tin add it later but retrieve to do so before it'south time to file.

At that place's also a checkbox to Track payments for 1099s. One time checked, QuickBooks will add the independent contractor to the tax filing module.

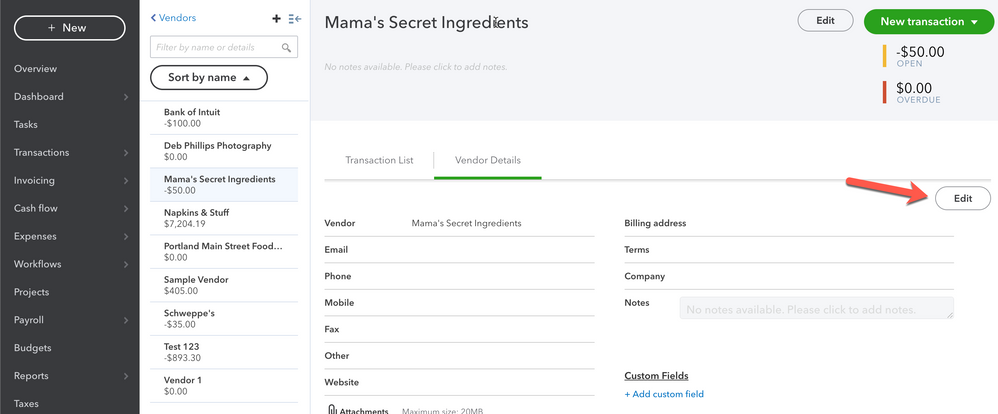

Before going any further, click on your new contractor's name and make sure all the information is right. Pay shut attention to their EIN and email address if you lot programme to send their 1099-MISC electronically.

Every bit always if yous need to make whatever changes, click on the vendor'southward proper name and and so Edit .

Note: You tin can apply this verbal same process to runway an existing vendor for a 1099-MISC. Remember, y'all will have to separate the expenses associated with products and services yous buy from the vendor versus expenses related to their contract labor. Be very deliberate well-nigh which business relationship y'all map expenses to on Expense forms.

You can see inside the vendor profile where you tin add together a default expense account.

We'll employ this for payments made to independent contractors. This step is especially of import for vendors you also buy products and services from. As mentioned above, expenses for products and services need to be differentiated from the work they practise.

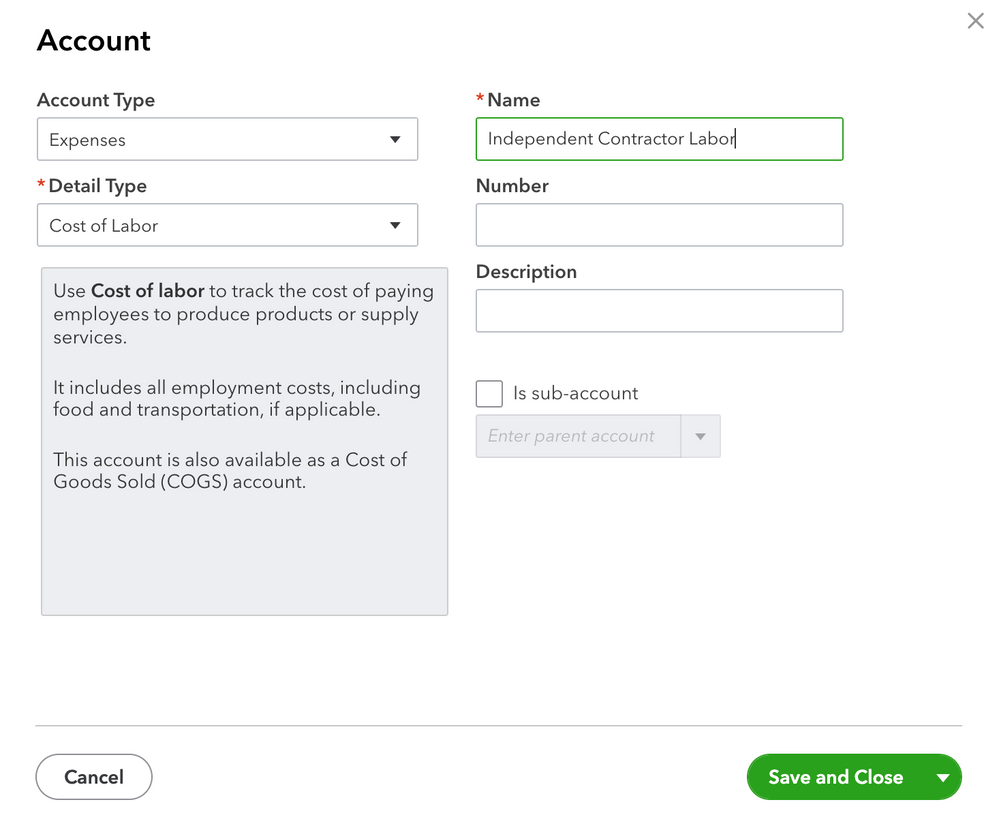

Become to the Bookkeeping tab and click on your Chart of Accounts . Create a new account like the 1 pictured beneath:

- Proper name the account Independent Contractor Labor or something else that makes sense and is easy to remember

- Select Expenses as the Account Blazon and Toll of Labor every bit the Detail Type

- From now on, every fourth dimension you enter an expense or pay a check to your independent contractors, map those transactions to this new Expense account.

Since yous've been tracking their payments exclusively with that special contractor Expense Account, filing the 1099-MISCs will exist a piece of block.

In Step 2 of the Set 1099s module, select Box 7: Nonemployee Compensation. Cull the account you used to pay your contractors. This tells the IRS what coin was used for non-employee compensation.

In Step 3 , the Vendors you lot started tracking will automatically appear on the listing. If y'all don't run into one of your contractors, simply edit their profile using the steps higher up and choose the Track payments for 1099s checkbox. Consummate the module and you're ready to send out 1099-MISCs to your independent contractors.

Tips and Reminders:

- Ever be enlightened of which Expense account you're using when yous enter expenses related to contained contractors.

- Use the memo and description fields to further document what these types of expenses are for so you won't have to approximate during the rush of tax season.

- What's most important is knowing which expenses apply to the 1099-MISC. This is no piece of cake chore, but the IRS website provides a comprehensive listing you can utilize as a reference.

- If yous already entered labor expenses for a Vendor into a different expense business relationship before going through this procedure, go back and recategorize those transactions into the new "Independent Contractor Labor" business relationship.

There y'all have it! We went from setting up contractors to expense forms to filing for 1099s. I promise this was helpful and gave you an in-depth overview of how QuickBooks Online handles vendors. As always, reach out to the Community if you accept questions. We're here to help!

How To Set Up Subcontractors In Quickbooks,

Source: https://quickbooks.intuit.com/learn-support/getting-started-with-quickbooks/how-to-add-independent-contractors-and-track-them-for-1099s-in/ta-p/171716

Posted by: searcyoncely.blogspot.com

0 Response to "How To Set Up Subcontractors In Quickbooks"

Post a Comment